The payment is accepted and guaranteed by the bank as a time draft to be drawn on a deposit. A bankers acceptance is a financial instrument that most commonly occurs in international trade transactions.

The Extraordinary 31 Construction Proposal Template Construction Bid Forms With Free Construction Construction Bids Proposal Templates Free Proposal Template

A short-term debt instrument issued by a company that is guaranteed by a Commercial Bank.

. Advantages of Double Entry Accounting system. It is backed by a banks promise to pay and hence is considered to be a safe investment. For example say the banker has an acceptance liability of 150000 for the trade execution.

Journal entries in the books of consignor - Accounting For. Learn More. Paid acceptance to Bala Ram for Rs.

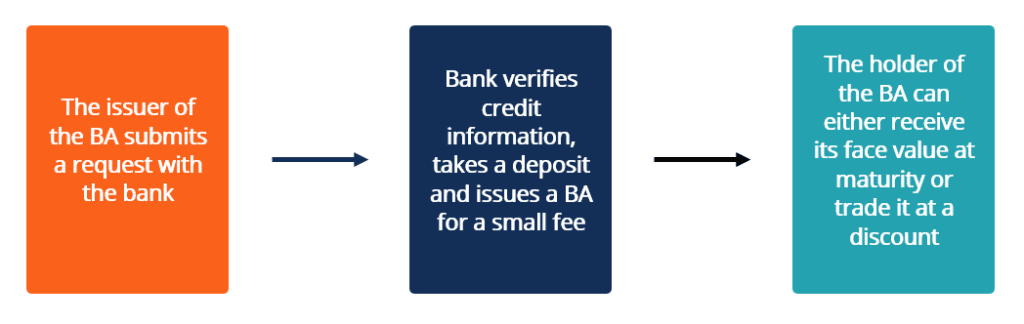

Banker acceptance double entrybanker acceptance double entry. The drawer of a bankers acceptance should account for the transaction in the same way as for a bill of exchange. Considered negotiable instruments with features of a time draft bankers acceptances are created by the drawer and provide the bearer with the right to the amount noted on the face of the acceptance on the specified date.

If the bank has a good reputation the acceptance can be resold in an open. On the due date the bill is dishonoured the bank paying Rs 10 as noting charges. The customer makes the payment to the business.

C gets it discounted with his bankers at 18 per cent annum on 4th May. Accounting treatment of bankers acceptances by the drawer borrower. The discount rate is known as the bankers acceptance rate and it is the market rate at which bankers acceptance trade in the secondary market.

It is merely an order by the drawer to the bank to pay a specified sum of money on a specified date to a named person or to the bearer of the draft. This is arrived by preparing a trial. A bankers acceptance is an instrument representing a promised future payment by a bank.

These financial instruments are often traded at a discount to their face value. Purchased equipment for 650000 in cash. C agrees to accept Rs 2130 in cash.

As both the personal and impersonal accounts are maintained under the double entry system both the effects of the transactions are recorded. A double entry accounting system requires a thorough understanding of debits and credits. There are three stages in the bills receivable accounting process.

A bankers acceptance BA aka bill of exchange is a commercial bank draft requiring the bank to pay the holder of the instrument a specified amount on a specified date which is typically 90 days from the date of issue but can range from 1 to 180 days. The holder exporter to whom such assurance is provided can sell the instrument in the secondary market Secondary Market A secondary market is a platform where investors can easily buy or sell securities once issued by the original issuer be it a bank corporation or government entity. The entry is a debit of 10000 to the cash asset account and a credit of 10000 to the notes payable liability account.

Before acceptance the draft is not an obligation of the bank. The customer accepts the bill of exchange and the business transfers the asset to a bills receivable account. After acceptance the draft becomes an.

A bankers acceptance arises when a bank guarantees or accepts corporate debt usually when it issues a loan to a corporate customer and then sells the debt to investors. It provides a bridge between an importer and an exporter when they do not have an established relationship. Because of the bank guarantee a bankers acceptance is viewed as an obligation of the bank.

A bankers acceptance can be used by an importer to finance his purchases or can be created through a letter of. A bankers acceptance or BA is a time draft drawn on and accepted by a bank. It assures arithmetical accuracy of the books of accounts for every debit there is a corresponding and equal credit.

The bankers acceptance is issued at a discount and paid in full when it becomes due. Thus you are incurring a liability in order to obtain cash. You borrow 10000 from the bank.

Upon acceptance which occurs. Finally the usual entry for acceptance of a fresh bill is passed. Their definitions are noted below.

When a contra entry posted in cash book there is a reference column the letter C is written this denotes that the entry is a contra entry. B sends his promissory note for 3 months to C for Rs 6000 on May 1 2011. The draft specifies the amount of funds the date of the payment or maturity and the entity to which the payment is owed.

Banker acceptance double entryvanderbilt school of engineering acceptance rate. The business sells goods to a customer and records the amount owed as an accounts receivable asset in the normal manner. In May 1979 a type of negotiable instrument known as a bankers acceptance BA was introduced into the Malaysian financial market.

/close-up-of-safe-116362698-8291c470571a470195cf330f97659243.jpg)

Banker S Acceptance Ba Definition

:max_bytes(150000):strip_icc()/GettyImages-1351380436-3f806ad1e7354802a43abfd60bbad626.jpg)

Banker S Acceptance Ba Definition

Printable Sample Offer Letter Sample Form Jobs For Teachers Letter Templates Free Lettering

Banker S Acceptance Overview How It Works Investing Tool

:max_bytes(150000):strip_icc()/GettyImages-926899670-6bebed4430e44ac4a5ee31e67553e292.jpg)

Banker S Acceptance Ba Definition

How To Conduct Effective Software Testing When Migrating Data Fortude

Funny Accountant Gifts A Day Wothout Accounting Is Like Sarcasm Coffee Mug For Women Men Tax Accountanting In 2022 Accountant Gifts Funny Accountant Mugs

Job Offer Letter With 6 Templates

Index Funds Investing 101 A Complete Beginner S Guide

Job Offer Letter With 6 Templates

Uniuyo 2018 2019 Basic Studies And Pre Degree Direct Entry Admission Lists Has Been Released By The University Au List Of Courses University Faculty Of Science

Template For Bid Proposal Construction Bids Proposal Templates Free Proposal Template

Banker S Acceptance Ba Definition

Funny Accountant Gifts A Day Wothout Accounting Is Like Sarcasm Coffee Mug For Women Men Tax Accountanting In 2022 Accountant Gifts Funny Accountant Mugs

/78394716-5bfc38b5c9e77c00587aa957.jpg)